How to Use the LIC Amritbaal Plan Calculator: A Comprehensive Guide

Are you thinking about securing your child’s future with the LIC Amritbaal Plan but unsure about the premiums or benefits? Don’t worry!

The LIC Amritbaal Plan Calculator is here to simplify everything for you. This online tool helps you calculate premiums, maturity amounts, and death benefits with just a few clicks.

In this guide, we’ll explain how to use the LIC Amritbaal Calculator step by step. It’s simple, engaging, and perfect for planning your child’s future. Let’s dive in!

What is the LIC Amritbaal Plan Calculator?

The LIC Amritbaal Plan Calculator is an online tool provided by the lic calculator premium.in It’s designed for the Amritbaal Plan (Plan 874), a policy created to secure,

your child’s dreams—be it education, marriage, or anything else. With this calculator, you can input details like your child’s age, sum assured, and policy term to get instant results, including:

- The premium you’ll need to pay (single or limited).

- The maturity amount at the end of the term.

- The death benefit in case of an unfortunate event.

If you’re looking for the LIC Amritbaal Plan 874 Calculator, this is the tool you need!

Why is the LIC Amritbaal Premium Calculator Important?

Wondering why you should use the LIC Amritbaal Premium Calculator? Here are some great reasons:

-

- Accurate Results: Get exact figures based on your inputs.

-

- Saves Time: No need to calculate manually.

-

- Flexible Options: Adjust the sum assured or term to see different outcomes.

-

- Clear Insights: Understand your payments and returns easily.

-

- Confident Planning: Make smart decisions for your child’s future.

Whether you call it the Amritpal LIC Policy Calculator or the LIC Amritbaal Maturity Calculator, it’s a must-have tool for stress-free planning.

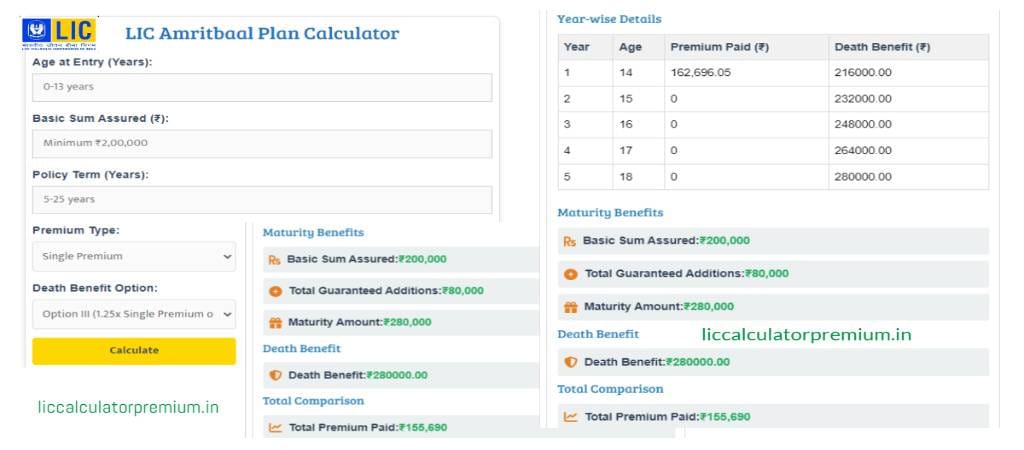

How to Use the LIC Amritbaal Plan Calculator: Step-by-Step Guide

Ready to try the LIC Amritbaal Plan Calculator India? Follow these simple steps:

Step 1: Access the Calculator

Step 2: Enter Your Child’s Age

-

- Input your child’s current age (between 0 and 13 years).

-

- Tip: The age you enter affects the premium, so double-check it.

Step 3: Choose the Sum Assured

-

- Pick the sum assured (minimum ₹2,00,000).

-

- What’s this?: It’s the guaranteed amount paid at maturity or to the nominee if needed.

Step 4: Select the Policy Term

-

- Choose how long the policy will run (5 to 25 years).

-

- Note: The child’s age + policy term should not exceed 25 years.

Step 5: Pick the Premium Type

-

- Decide between a single premium (one-time payment) or limited premium (pay for 7 years).

-

- The LIC Amritbaal Plan Premium Calculator adjusts based on your choice.

Step 6: Select the Death Benefit Option

-

- For single premium: Option III (1.25x premium) or Option IV (10x premium).

-

- For limited premium: Option I (7x premium) or Option II (10x premium).

-

- Suggestion: Higher options mean more coverage but may increase costs.

Step 7: Click “Calculate”

-

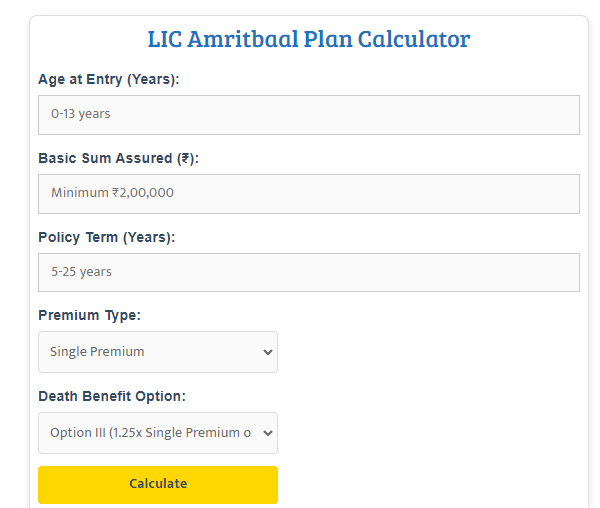

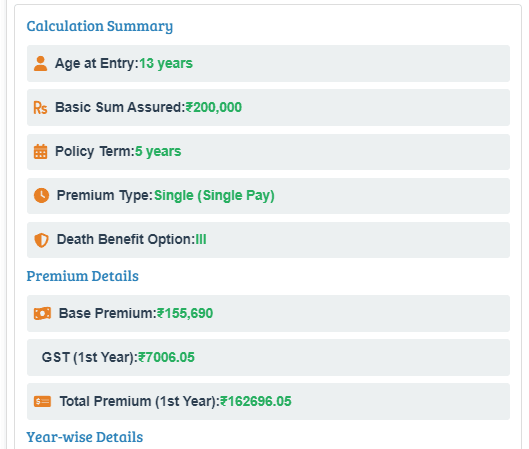

- Press the calculate button to see your results, including:

-

- Base Premium: Amount before tax.

-

- GST: Tax (4.5% in year one, 2.25% after).

-

- Total Premium: Final amount to pay.

-

- Maturity Amount: Sum assured + guaranteed additions.

-

- Death Benefit: Payout if the policyholder passes away.

-

- Press the calculate button to see your results, including:

Step 8: Adjust and Finalize

-

- Want to tweak something? Change the sum assured or term and recalculate.

-

- Happy with the results? Contact an LIC agent to buy the plan.

Bonus Tip: Use the “Clear” button to start over and explore different options.

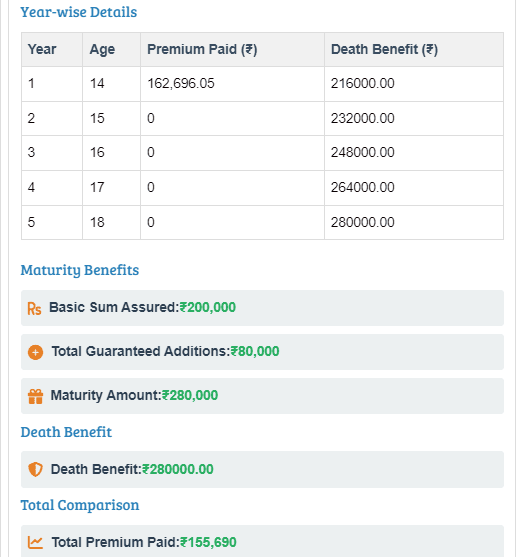

How to Understand the Output?

The LIC Amrit Bal Plan Calculator gives you these key details:

-

- Base Premium: The amount before adding tax.

-

- GST: Tax added to the premium.

-

- Total Premium: What you’ll actually pay.

-

- Guaranteed Additions: Extra amount added yearly (₹80 per ₹1,000 sum assured).

-

- Maturity Amount: Total payout at the end of the term.

-

- Death Benefit: Amount paid to the nominee if needed.

You’ll also see a year-wise table breaking it all down.

Common Questions and Answers

Got questions about the Amritpal Policy Calculator? Here are some answers:

1. Is the LIC Amritbaal Calculator Accurate?

Yes, it’s reliable, though final rates depend on LIC’s current terms.

2. Can I Try Different Policy Terms?

Yes! Test any term between 5 and 25 years.

3. What’s the Difference Between Single and Limited Premium?

-

- Single: Pay once and you’re done.

-

- Limited: Pay yearly for 7 years.

4. How Do I Choose the Death Benefit Option?

Pick based on your budget and how much coverage you want. Compare options with the calculator.

5. Can I Check Maturity Amounts for Different Sum Assured?

Definitely! Adjust the sum assured and hit calculate again.

Conclusion: Secure Your Child’s Future

The LIC Amritbaal Plan is a wonderful way to ensure your child’s dreams come true, and the LIC Amritbaal Plan Calculator makes it super easy. With this guide, you can calculate premiums, explore options, and pick the perfect plan.