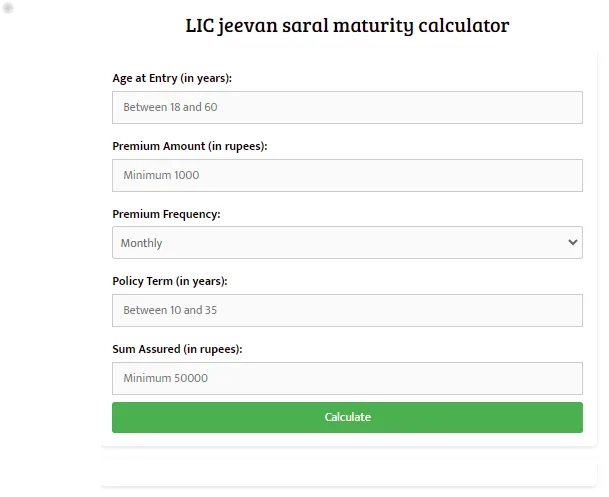

LIC jeevan saral maturity calculator

Discover Your Returns: How to Use the Jeevan Saral Maturity Calculator on Our Website

Have you ever wondered how much your LIC Jeevan Saral policy will pay out at maturity? With our newly launched Jeevan Saral maturity calculator, you can now estimate your returns in seconds! Designed for simplicity and packed with smart features,

this online tool is live on our website, ready to help you plan your financial future. In this blog, we’ll guide you through how to use the Jeevan Saral 165 maturity calculator, explore its benefits, and show you why it’s a must-try for LIC policyholders. Let’s get started!

What is the Jeevan Saral Maturity Calculator?

The Jeevan Saral maturity calculator is a free, web-based tool crafted to estimate the maturity benefits of your LIC Jeevan Saral policy (Plan 165). Whether you’re tracking your investment or planning a major life goal, this calculator takes your inputs—like age, premium, and term—and delivers a clear estimate of your payout, complete

with a visual growth chart. It’s now live on our website, making it easier than ever to unlock the value of your LIC Jeevan Saral plan 165 maturity value calculator.

Why Use Our Online Calculator?

Unlike standard tools like the LIC India maturity calculator, our version stands out with:

- User-Friendly Design: No tech skills needed—just a few clicks.

- Instant Results: Get your maturity estimate in real-time.

- Growth Visualization: See how your investment grows over time with a dynamic chart.

Ready to try it? Here’s how to use it on our website.

How to Use the Jeevan Saral Maturity Calculator on Our Website

Follow these simple steps to calculate your LIC 165 maturity calculator results:

Step 1: Visit Our Website

- Action: Head to [ calculator]

- What You’ll See: A page titled “LIC Jeevan Saral Plan 165 Maturity Calculator” with a clean, welcoming interface.

Step 2: Input Your Details

- Age (in years): Enter your age when you started the policy (between 18 and 60).

- Example: If you were 32, type “32.”

- Age (in years): Enter your age when you started the policy (between 18 and 60).

- Premium Amount (in rupees): Input your premium (minimum 1000 rupees).

- Example: For Rs. 5,000 annually, enter “5000.”

- Premium Amount (in rupees): Input your premium (minimum 1000 rupees).

- Policy Term (in years): Specify your policy duration (between 10 and 35 years).

- Example: For a 25-year term, type “25.”

- Policy Term (in years): Specify your policy duration (between 10 and 35 years).

- Guidance: Each field has placeholders (e.g., “Between 18 and 60”) to help you.

Step 3: Hit “Calculate”

- Action: Click the green “Calculate” button below the input fields.

- Validation: If your inputs are invalid (e.g., age below 18 or premium under 1000), you’ll see an alert like “Premium amount must be at least 1000 rupees.”

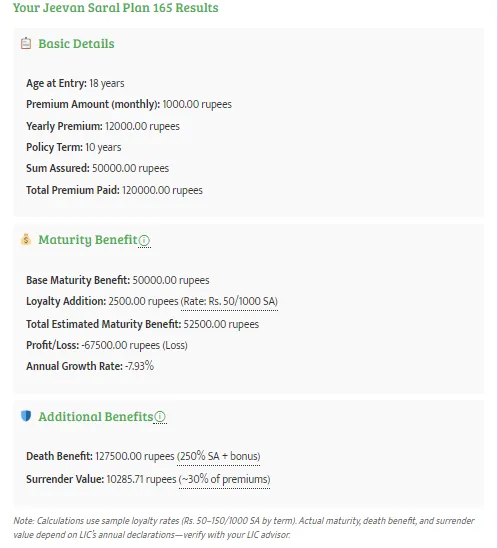

Step 4: Check Your Results

- Maturity Benefit: A message appears, e.g., “Maturity Benefit: 187500.00 rupees” (based on a sample formula: premium × term × 1.5).

- Growth Chart: A line graph shows your benefit growing year-by-year, with “Year” on the x-axis and “Amount (rupees)” on the y-axis.

Step 5: Plan Your Next Move

- What It Means: This is an estimate. The actual payout from your LIC Jeevan Saral with profits maturity calculator online may include loyalty additions.

- Action: Use the result to plan savings or consult your LIC agent for exact figures.

Real-World Example

Imagine ashish, 40-year-old policyholder, paying Rs. 2,000 monthly for a 20-year term:

- He visits our website and opens the Jeevan Saral plan 165 maturity calculator.

- He enters:

- Age: 40

- Premium: 2000

- Premium Frequency: manthly

- Term: 20

- Sum Assured : 50000

- He enters:

- He clicks “Calculate.”

- Result: “

Basic DetailsAge at Entry: 40 yearsPremium Amount (monthly): 2000.00 rupeesYearly Premium: 24000.00 rupeesPolicy Term: 20 yearsSum Assured: 50000.00 rupeesTotal Premium Paid: 480000.00 rupees

Maturity Benefit

Base Maturity Benefit: 50000.00 rupeesLoyalty Addition: 5000.00 rupees (Rate: Rs. 100/1000 SA)Total Estimated Maturity Benefit: 55000.00 rupeesProfit/Loss: -425000.00 rupees (Loss)Annual Growth Rate: -10.27%Additional Benefits

Death Benefit: 130000.00 rupees (250% SA + bonus)Surrender Value: 82285.71 rupees (~30% of premiums)

- Result: “

ashish now knows his potential returns and can adjust his financial plans accordingly!

Benefits of Using Our Jeevan Saral Calculator

- Convenience: Access the calculator of LIC anytime, anywhere—no downloads needed.

- Visual Clarity: The growth chart makes it easy to understand your investment’s progress.

- Free and Fast: Unlike manual calculations or Excel-based LIC Jeevan Saral plan 165 maturity calculator Excel, this is instant and cost-free.

While it doesn’t yet calculate extras like LIC surrender value after 10 years calculator, it’s a solid starting point for maturity planning.

Limitations to Keep in Mind

- Estimate Only: The maturity calculator LIC uses a basic formula for demonstration. Real LIC payouts include bonuses that vary yearly.

- Customization: For precise results, replace the sample formula with LIC’s official calculation (consult an expert for this).

How to Find the Calculator on Our Site

- Direct Link: Bookmark [ Lic jeevan saral maturity calculator ] for quick access.

- Search Option: Type “Jeevan Saral maturity calculator” in our site’s search bar.

- Mobile-Friendly: Use it on your phone or tablet—no app required!

Pro Tips for Users

- Experiment: Play with different premium amounts or terms to see how they impact your returns.

- Combine Tools: Pair this with a LIC calculator premium to plan your policy from scratch.

- Stay Informed: Check LIC updates for loyalty addition rates to refine your estimate.

3 thoughts on “Calculate Your Returns with the Jeevan Saral Maturity Calculator – LIC Plan 165 Guide”

Comments are closed.